The Tax Man Cometh

This is the week when many taxpayers are confronted with the April 15th deadline for filing their income taxes. One of my constituents called me on the phone and asked me what I thought about it. The simplest way to explain it is like this:

If you wanted to donate your own money to the cause, nothing is stopping you from doing this right now. The purpose behind a tax increase is to use the iron fist of government to compel one’s neighbors to pay more than they would have been willing to pay from their own reasoning—and possibility from their own ability.

I feel sorry for all of us—those who are either ill-informed or don’t care about the hardships they may be putting on others. The nature of tax increases is that there will never be enough money for all the projects bureaucrats can invent. We already experience tax increases through inflation. Therefore, when taxing jurisdictions claim they haven’t had a tax increase in so many years, that’s because the system was designed to be proportionate to property values. It inflates up (and on rare occasions can go down) with the wealth of the community.

Short of a large-scale disaster necessitating a sudden lay out of money, there is nothing precipitating any need. Even if there were a disaster, when you consider all the private insurance money, FEMA money, churches and other charitable organizations, in addition to families and neighbors demonstrating goodness and generosity in the hearts of Americans wanting to help, there should be enough to rebuild without another tax increase. The governing boards should be planning and saving each year so that when they want to spend, they already have a fund available to accommodate it.

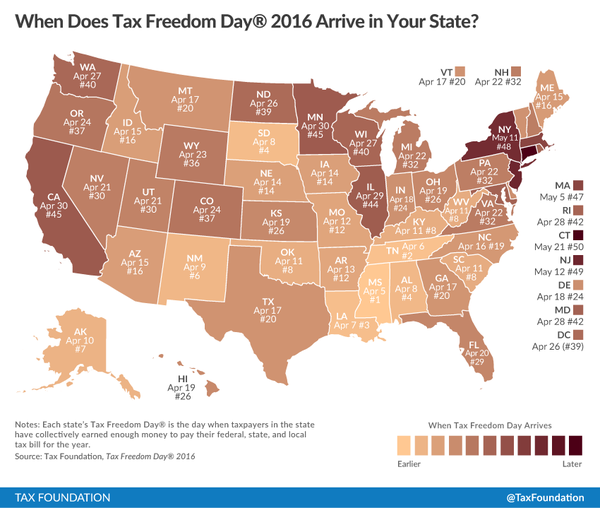

This map shows the date when you can stop working for the government and start working for your own benefit. The lighter the state, the better.

Nevertheless, the worst taxes aren’t the ones that stay in our communities or even our states. The worst taxes are the ones that go to the big black hole in Washington D.C. where there is even less accountability.

Many people are particularly unhappy with their health insurance premiums and penalties they are being forced to pay if they don’t have an Obama-qualified insurance plan. If we abolished the I.R.S., we could take a big step forward in stopping this government-mandated coercion.

There are steps our Congress can take to make this happen. All it takes is a few good people ready to roll up our sleeves and get to work. I am one of those people. If your member of Congress votes for more spending, here is a live chart that shows how much our deficit is growing every second.

Many friends, my husband included, are being drained not just financially, but emotionally with all the time, energy and effort through this oppressive system. One of my friends wrote this to me:

“I spent 10 hours doing our taxes today so that [my husband] wouldn’t have to deal with it so I’m exhausted and cranky. I’m counting on you to help overhaul that tax system and simplify when you are in Congress!”

Now I want to hear your thoughts. Let me know how you feel about our income tax system and your ideas you want to see changed.

On our podcast today, I interview a national expert on our healthcare system. She was a nurse from Minnesota who decided to do something about exposing the wrongness of government meddling in our free market system of healthcare. You will want to hear our exceptional show with Twila Brase this week.

[stextbox id=”Gray”]

WHAT YOU CAN DO…

1.) I am running for Congress, however the purpose of this newsletter is to be educational. If you are interested in our campaign, you can go to:

CynthiaDavis.us. There you can learn more about what we are doing on the campaign trail, volunteer and donate to the cause.

2.) Enjoy our podcast this week and share it with friends. It will encourage you. If you want to get a notice every time we have a new podcast, just click the highlighted button to sign up on iTunes.

2.) We’re asking for donations to promote awareness of Home Front. Even $5 or $10 will go a long way. If you want to contribute to this effort, it will help others become aware of our newsletter and our show. Our newsletter and podcast will educate others. Please consider sending a donation to keep us going. Since we do not have any other funding stream, your donation will be extremely helpful, especially for the sake of our experiment. Many people do not realize we are a volunteer entity and rely on their assistance along with God’s leading to continue. If you would like to help, please mail a check to:

Cynthia Davis

1008 Highway K

O’Fallon, Missouri 63366

Thank you for your consideration!

[/stextbox]

This Week On Home Front:

Listen to This Episode of Home Front Now

Home Front is also part of the Missouri Grassroots Radio lineup

A Little Bit of Humor…

3 Comments

David G. Baugh, 80 Liberty Road, Steelville, MO 65565 573-775-2109

Cynthia, you and your family, friends, and associates would do well to study and learn the tax laws and your alleged liability there under. Please take advantage of this opportunity to do so and join the several hundreds of thousands (millions) of others who have:

https://www.youtube.com/watch?v=hgzzYl-eeUI&feature=youtu.be

Get the book (now in it’s 14th printing), learn, apply what you learn, and get yourselves free from the yoke of bondage built upon deceit, lies and fraud.

Peter Albrecht

I totally agree with your position on new taxes. We need more folks in congress with the same understanding. Let me know when I can vote for you again!

Amy Hunter

I believe the government requires taxes to pay for way more programs than the public should ever have to pay for, many programs that the government shouldn’t be involved in. For instance, I think we should do away with welfare programs and let local communities, churches, organizations, friends and family help each other out.

Quite simply, I believe our taxes at any level should cover the following : education at any level, infrastructure, first responders, armed services, veterans benefits, government salaries. But members of congress should have the same healthcare and retirement benefits as the rest of the country. I also believe prison costs should be offset by requiring prisoners to perform some kind of work while incarcerated, be it work within the facility (cook, clean, etc), or assist with programs like training dogs to asssist vetetans or the disabled. I could go on and on…..